Impact Investing

In addition to our grantmaking, the Lawson Foundation is leveraging its assets to create social good through impact investing.

The Lawson Foundation believes that by targeting a portion of its endowment for impact investing we can generate a blended value return that can significantly multiply our impact on communities and generate financial returns with an acceptable risk profile. Our Impact Investment Committee guides the development of this work.

The Foundation sees impact investing as an extension of our grant making and as a means to expand our reach and impact. Using our broader financial assets in this way adds an additional device in our toolkit to do good and to fulfill our mission as a foundation. Impact investing also allows us to expand in new areas that our members have identified as important but that are not currently priority themes for our granting areas of focus. For these reasons, our impact investments are not limited to our granting impact areas.

We recognize that while financial returns are quantifiable, defining and measuring the social impact or return is still very difficult to do. While we must continuously strive to measure more effectively and identify appropriate methodologies, the challenges in this kind of work should not hamper our desire to engage in impact investing.

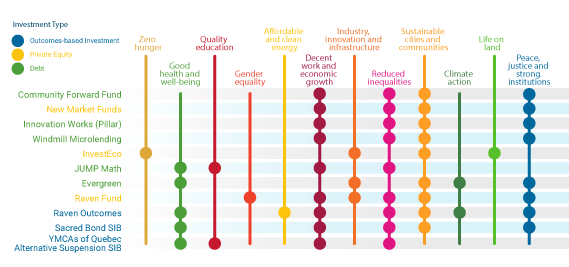

Aligning our investments to the Sustainable Development Goals

The Sustainable Development Goals (SDGs) were adopted by the United Nations in 2015 as a universal call to action to end poverty, protect the planet, and ensure that by 2030 all people enjoy peace and prosperity. The 17 SDGs are integrated—they recognize that action in one area will affect outcomes in others, and that development must balance social, economic and environmental sustainability. The SDGs are designed to end poverty, hunger, AIDS, and

Every investment in our portfolio contributes to one or more SDGs:

Advancing our collective efforts toward reconciliation through our impact investments

The Lawson Foundation is committed to leveraging our work in the field of impact investing to advance meaningful reconciliation with Indigenous Peoples across the country. We were among the first funders in Canada to support an Indigenous-led community-driven outcomes contract with an investment in Aki Energy, which brought clean energy solutions to First Nations communities in Manitoba.

We are also proud to support and enable the leadership of Raven Capital Partners, an Indigenous-led financial intermediary, that is building an Indigenous social finance market in Canada. And we are pleased to be a part of the Province of Manitoba’s the Restoring the Sacred Bond Initiative, working to prevent infants from coming into care and reducing time spent in care by early reunification.

All of this work has been undertaken in collaboration and under the guidance of Indigenous partners. In this spirit we are learners first, and are grateful for the opportunity to share our experience with the goal of encouraging other funders and investors to be a part of this journey toward economic reconciliation and resilience for Indigenous Peoples.

Active Impact Investments

- Aki Energy

- Community Forward Fund

- Innovation Works II

- InvestEco

- Jump Math

- New Market Funds

- Raven Indigenous Impact Fund

- Raven Indigenous Impact Fund II

- New Market Funds II

- Restoring the Sacred Bond

- Trillium Housing

- Windmill Microlending

- YMCAs of Quebec

Aki Energy Community-Driven Outcomes Contract – $250,000

Investment Overview

Aki Energy is an Indigenous-led non-profit social enterprise enabling clean energy solutions in remote communities. This community-driven outcomes contract, structured through Raven Capital Partners as the financial intermediary, supports the installation of 125 residential geothermal units in four on-reserve communities in Manitoba – Fisher River, Sagkeengk, Long Plains and Peguis First Nations.

Rationale for Investment

This investment is an opportunity for the Foundation to be engage in an innovative social finance tool and a paradigm shift in social impact measurement that puts Indigenous values, outcomes and indicators at the center. The Foundation has worked in partnership with government, philanthropy, and Indigenous communities since 2016 to launch this tool, built on a year-long, multi-sectoral Solutions Lab process. A key objective is to build, de-risk and simplify pathways to scale so that government and utilities can learn to engage in outcomes buying with Indigenous communities.

Aligned Sustainable Development Goals

|

|

|

|

|

|

|

Community Forward Fund – $1,000,000

Investment Overview

The Community Forward Fund (CFF) provides loans or arranges financing exclusively for Canadian nonprofits and charities. It is specifically designed to address a gap in access to patient, working capital and bridge loans for the charitable and nonprofit sector. CFF also provides financial review/advisory services as well as coaching services and assessment tools to help build financial skills and capacity in the charitable and nonprofit sector.

Rationale for Investment

CFF addresses gaps that traditional financing cannot fill, particularly for growth and working capital for nonprofits and charities. It offers the opportunity to support an innovative impact investment—a pan-Canadian sponsored fund dedicated to capacity-building in the charitable sector. This investment was the Foundation’s first impact investment.

Aligned Sustainable Development Goals

|

|

|

|

Innovation Works – $250,000

Investment Overview

This is a second community bond for Innovation Works. A community bond is an interest-bearing loan that allows investors to align their investments with their values, while enjoying a stable return. Innovation Works is an initiative to provide collaborative shared space for charities, nonprofits and social enterprises that are working for social good in the London region in Ontario.

Rationale for Investment

The Foundation served as the lead investor in this high-impact opportunity to support community leadership and to cultivate the growing social finance culture in the London region. It aligns with the Foundation’s commitment to supporting infrastructure in the social and charitable sector and helps to continue the Foundation’s link to the London community.

Aligned Sustainable Development Goals

|

|

|

|

InvestEco – $500,000

Investment Overview

InvestEco is a mission-oriented, impact-investing firm that seeks to maximize financial, environmental and social returns. Since its founding in 2002, InvestEco has invested in over 15 private companies involved in a range of businesses including renewable energy and resource productivity technologies to sustainable food and agriculture initiatives.

Rationale for Investment

InvestEco’s goal is to address the significant challenges to the modern food and agriculture sector by investing in small, sustainable farms and food businesses that can produce healthier food in a way that reduces pollution, increases soil fertility, and supports agricultural communities. This investment aligns with the Foundation’s commitment to the environment and food security and represented its first investment in a direct Limited Partnership agreement.

Aligned Sustainable Development Goals

|

|

|

|

Jump Math – $400,000

Investment Overview

Founded in 2001 by mathematician and playwright, Dr. John Mighton, JUMP Math is a charity with a mission to enhance the potential of all children by encouraging an understanding and a love of math in students and in educators. JUMP Math operates as an award-winning social enterprise that creates and publishes effective, evidence-based classroom math programs for grades K-8.

Rationale for Investment

Numeracy is widely understood as a foundation of 21st Century economic competitiveness. JUMP’s programs are evidence-based and demonstrate a significant impact on education, future employment and Canada’s competitiveness in this knowledge-based global society. JUMP’s program is also being used by 25% of Indigenous elementary students on-reserve and is showing positive results. This investment aligns with the Foundation’s commitment to the healthy development of children and youth as well as Truth and Reconciliation.

Aligned Sustainable Development Goals

|

|

|

|

New Market Funds – $500,000

Investment Overview

New Market Funds (NMF) focuses on issue areas where social or environmental needs offer commercial growth opportunities for market rate return. NMF works closely with its sponsor organizations to isolate sectors, such as Affordable Rental Housing, that combine the opportunity to have a significant impact, market demand demonstrated by a robust pipeline, and an appropriate level of risk and return for investors.

Rationale for Investment

New Market Funds works to improve long-term access to housing for low- and moderate-income individuals and families, increase access to capital for nonprofits, and increase community ownership of housing projects. This investment offers the opportunity to support a pan-Canadian impact investment, build infrastructure for the charitable sector, and expand critical access to affordable housing.

Aligned Sustainable Development Goals

|

|

|

|

Raven Indigenous Impact Fund – $250,000

Investment Overview

Raven Capital Partners is a Canadian Indigenous-focused fund management company creating finance solutions serving Indigenous enterprises and communities. They believe that investing from a platform of Indigenous values in Indigenous social enterprises can address our biggest social, economic and environmental challenges. They work in partnership with social enterprises to build strong business foundations, provide bespoke technical assistance and bring enterprises to scale. Their objective is to help entrepreneurs achieve their goals, build an Indigenous economy and have lasting impact.

Rationale for Investment

As part of the Foundation’s commitment to Truth and Reconciliation, this investment supports Raven’s vision to catalyze long-term economic change and build an Indigenous economy. It represents an opportunity to demonstrate what can be achieved by mobilizing investor capital to support Indigenous social enterprises.

Aligned Sustainable Development Goals

|

|

|

|

|

|

Raven Indigenous Impact Fund – $750,000

Investment Overview

Raven Capital Partners is a Canadian Indigenous-focused fund management company creating finance solutions serving Indigenous enterprises and communities. They believe that investing from a platform of Indigenous values in Indigenous social enterprises can address our biggest social, economic and environmental challenges. They work in partnership with social enterprises to build strong business foundations, provide bespoke technical assistance and bring enterprises to scale. Their objective is to help entrepreneurs achieve their goals, build an Indigenous economy and have lasting impact.

The purpose of Raven Fund II is to invest in approximately 18 Indigenous enterprises, with up to half of the investments made in either Canada or the United States. The Indigenous enterprises sought will be late seed or early stage, with significant provisioning for Series A and B funding rounds, and early signs of market traction and potential for scale. The fund will invest $2 million to $5 million per company, seeking a 3x deal-level return, with a 10% to 25% ownership stake. Sectors will include technology, food sovereignty, health and health informatics, and natural products.

Rationale for Investment

As part of the Foundation’s commitment to Truth and Reconciliation, this investment supports Raven’s vision to catalyze long-term economic change and build an Indigenous economy. It represents an opportunity to demonstrate what can be achieved by mobilizing investor capital to support Indigenous social enterprises. The Lawson Foundation is a current investor in the Raven Indigenous Impact Fund I, with a term expected to end in 2029. The Foundation is also an investor in Raven Indigenous Community Outcomes, a community-driven outcomes contract established by Raven Capital Partners to install renewable energy units in remote northern Manitoba Indigenous communities. The contract and related work have now been completed and the Foundation has received its full success payment. The Foundation also partners with Raven for their work on the Diabetes Reduction Bond and related Indigenous Solutions Lab.

Aligned Sustainable Development Goals

|

|

|

|

|

|

New Market Funds II – $500,000

Investment Overview

New Market Funds (NMF) focuses on issue areas where social or environmental needs offer commercial growth opportunities for market rate return. NMF works closely with its sponsor organizations to isolate sectors, such as Affordable Rental Housing, that combine the opportunity to have a significant impact, market demand demonstrated by a robust pipeline, and an appropriate level of risk and return for investors.

Rationale for Investment

Based on Fund I’s achievements and the strong pipeline of potential projects, NMF is raising capital for a second, larger affordable rental housing fund, Fund II, whose purpose is to acquire stabilized newly constructed or substantially renovated affordable rental housing developments and/or acquire rental properties for ultimate conversion to nonprofit ownership. The target fund size of $50 million is expected to be achieved in 2022 and would enable the creation of over 2,000 units of new or preserved affordable housing through 10-15 stabilization (new) and acquisition (preservation) deals. Every $5 million invested is expected to leverage $65 million from other sources and result in 200 units of permanently affordable housing reconnecting rents to incomes. This investment offers the opportunity for the foundation to continue to support a pan-Canadian impact investment, build infrastructure for the charitable sector, and expand critical access to affordable housing.

Aligned Sustainable Development Goals

|

|

|

|

Restoring the Sacred Bond – $250,000

Investment Overview

The Restoring the Sacred Bond Initiative seeks to improve maternal and child health, build strengths, cultural identity and social outcomes in First Nations communities in Manitoba through access to culturally grounded Birth Helpers. The two-year pilot project will match Indigenous Birth Helpers with Indigenous mothers, with a key goal of reducing the number of First Nations infants apprehended into the child welfare system. The initiative is funded through Manitoba’s first Social Impact Bond.

Rationale for Investment

Almost 90% of the children in care in Manitoba are Indigenous. Each year between 2015 and 2019, Manitoba Child and Family Services apprehended on average 670 children in the first year of life. More than a quarter of these children can expect to remain in care for at least twelve years. The Foundation invested in this Social Impact Bond because of the broad community support it received in addressing this critical child welfare issue.

Aligned Sustainable Development Goals

|

|

|

|

|

Trillium Housing Bond – $250,000

Investment Overview

Trillium is a shared equity housing provider in the GTHA. Their Trillium Mortgage helps moderate- income individuals and families afford safe, decent homes by sharing the cost of the mortgage with Trillium. The Trillium Housing Bond Pickering will fund Trillium’s Pickering housing development, which will build 264 affordable stacked townhouse units. The units in this development will be mostly two- and three-bedroom units. Targeted buyers are moderate-income families with household incomes of less than 60% of median income, with preference for single mothers and families with children. Trillium anticipates serving families with an average household income of $66,000 on average. Several hundred have already signed up for units.

Rationale for Investment

Affordable homeownership can have a multi-generational impact on family prosperity and Trillium’s focus on families with children aligns with Lawson’s strategic priorities. The return is fair and exit confidence is strong, due to Trillium’s extensive experience and the Trillium Mortgage is an innovative financial model that could have scalable impact.

Aligned Sustainable Development Goals

|

|

Windmill Microlending – $250,000

Investment Overview

Windmill Microlending supports newcomers equipped with excellent professional skills and knowledge but face significant barriers to employment by providing micro loans of up to $10,000 so they can obtain the Canadian licensing or training they need to work in their field.

Rationale for Investment

Each year, thousands of immigrants arrive in Canada equipped with valuable skills, education and experience. They often fall into unemployment or low-paying “survival” jobs, unable to work in their pre-migration field because they lack Canadian licensing/training or the credit history to access financing for that training. This investment supports the Foundation’s pan-Canadian scope and provides opportunities for immigrants across the country to integrate into the workforce and become productive, engaged members of their communities.

Aligned Sustainable Development Goals

|

|

|

|

YMCAs of Quebec – Alternative Suspension Program – $500,000

Investment Overview

The YMCAs of Québec is raising capital through a social impact bond (SIB) to scale their Alternative Suspension Program across Canada. The program has been running successfully for 20 years. Currently, there are 35 program sites operational in Canada, three in France and one in the UK. The goal of the program is to decrease repeat suspensions and other school disciplinary sanctions for at-risk youth aged 12-17, thereby preventing school drop-out incidents and reducing risk factors for delinquency. The SIB will operate in 10 new sites and seek to enrol 1,600 students over three years.

Rationale for Investment

Since the Lawson Foundation began its impact investing activities in 2014, there have been few opportunities that aligned directly with the Foundation’s overall focus on the healthy development of children and youth. The Alternative Suspension SIB is an opportunity to invest in one such program that fits with the Foundation’s interest in community-based interventions and creating positive, enabling environments for children and youth.

Aligned Sustainable Development Goals

|

Past Impact Investments

Evergreen – $200,000

Investment Overview

Evergreen is redeveloping the 53,000-square foot Kiln Building at the Don Valley Brick Works site into the Future Cities Centre. The Centre will be a physical hub for the activities of the Future Cities Network, harnessing the power of collective actions to build capacity and scale solutions across the country.

Rationale for Investment

The Future Cities Centre’s focus on a low-carbon economy will have positive environmental impact because of the building’s low-carbon profile and the ongoing programming to find transformative ways to create low-carbon, people-friendly cities. The Centre will create a space that encourages people from all parts of society to collaborate; that enables social enterprises and entrepreneurs to test their ideas; and that directly engages youth to develop their skills and capacity in this work. This investment also represents the Foundation’s first shared due diligence effort with the partner foundations in the Mission-Related Investment Advisory Committee.

Aligned Sustainable Development Goals

|

|

|

|

|

Innovation Works – $500,000

Investment Overview

Innovation Works is London’s first ever community bond. A community bond is an interest-bearing loan that allows investors to align their investments with their values, while enjoying a stable return. Innovation Works is an initiative to provide collaborative shared space for charities, nonprofits and social enterprises that are working for social good in the London region in Ontario.

Rationale for Investment

The Foundation served as the lead investor in this high-impact opportunity to support community leadership and to cultivate the growing social finance culture in the London region. It aligns with the Foundation’s commitment to supporting infrastructure in the social and charitable sector and helps to continue the Foundation’s link to the London community.

Aligned Sustainable Development Goals

|

|

|

|

Trec SolarShare Co-Operative – $200,000

Investment Overview

SolarShare is a non-profit cooperative with a mission to grow community-based solar electricity generation in Ontario by engaging citizens in projects that offer tangible environmental, social and financial returns. SolarShare provides an investment opportunity for large as well as very small investors who believe in solar power for a healthier environment.

Rationale for Investment

SolarShare projects are owned by local community cooperatives and increase clean energy generation in Ontario. They create jobs in those communities and support grassroots community engagement in renewable energy. The Foundation’s investment represents a commitment to the environment and how the environment can impact communities and the families and children who live there.

Aligned Sustainable Development Goals

|

|

|

|

|

Staff Contact

Amanda Mayer